Preparing for competitive exams like SSC, UPSC, RRB, Banking and other government exams can feel overwhelming especially when it comes to Economics One wrong concept one weak topic and it can cost you precious marks so exactly why a well structured Economics Practice Set 1 becomes a game changer for serious aspirants.

This Economics Practice Set 1 is designed to help beginners as well as revision-focused students build a strong foundation in core economic concepts asked in SSC, UPSC, RRB, Banking and all major competitive exams The questions are framed as per the latest exam trends focusing on clarity concept application and smart practice rather than rote learning.

This practice set reflects real exam level questions that boost both confidence and accuracy Whether you are starting your Economics preparation or looking for reliable revision material this set ensures you practice the most important Economics MCQs in a simple exam oriented manner.

If your goal is to score better with less confusion this Economics practice resource is made for you Clear explanations student focused structure and trust worthy content make it ideal for aspirants who want smart preparation not random practice aligned perfectly with today competitive exam demand.

Latest GK Test Series

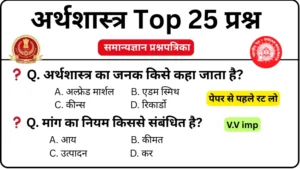

Economics Practice Set 1: for SSC, UPSC, RRB, Banking And All Competitive Exams

Q. Who is considered the father of economics?

A) Alfred Marshall

B) Adam Smith

C) Keynes

D) Ricardo

Correct Answer: B) Adam Smith

Q. Who wrote the book “Wealth of Nations”?

A) Adam Smith

B) Marshall

C) Keynes

D) Mill

Correct Answer: A) Adam Smith

Q. Microeconomics is concerned with?

A) National income

B) Inflation

C) Individual units

D) Economic development

Correct Answer: C) Individual units

Q. What does Gross Domestic Product (GDP) represent?

A) Total exports

B) Total income

C) The value of goods and services produced in the country

D) Total savings

Correct Answer: C) The value of goods and services produced in the country

Q. The law of demand is related to?

A) Income

B) Price

C) Production

D) Tax

Correct Answer: B) Price

Q. What happens to demand when the price increases?

A) Increases

B) Decreases

C) Remains the same

D) Becomes zero

Correct Answer: B) Decreases

Q. Which method is NOT used to calculate national income?

A) Production method

B) Income method

C) Expenditure method

D) Inflation method

Correct Answer: D) Inflation method

Q. Inflation means—

A) Decrease in prices

B) Continuous increase in prices

C) Decrease in production

D) Increase in unemployment

Correct Answer: B) Continuous increase in prices

Q. Which is the central bank of India?

A) SBI

B) RBI

C) NABARD

D) SEBI

Correct Answer: B) RBI

Q. When was the RBI established?

A) 1930

B) 1935

C) 1947

D) 1950

Correct Answer: B) 1935

Q. Who determines the bank rate?

A) Parliament

B) RBI

C) Ministry of Finance

D) SBI

Correct Answer: B) RBI

Q. Who presents the budget?

A) President

B) Prime Minister

C) Finance Minister

D) RBI Governor

Correct Answer: C) Finance Minister

Q. Unemployment means—

A) Not working

B) Not willing to work

C) Not getting work despite being willing to work

D) Receiving low wages

Correct Answer: C) Not getting work despite being willing to work

Q. Who replaced the Planning Commission in India?

A) NITI Aayog

B) Finance Commission

C) RBI

D) SEBI

Correct Answer: A) NITI Aayog

Q. Fiscal policy is related to?

A) Money supply

B) Taxes and government expenditure

C) Interest rate

D) Foreign trade

Correct Answer: B) Taxes and government expenditure

Q. Who formulates monetary policy?

A) Parliament

B) Government

C) RBI

D) NITI Aayog

Correct Answer: C) RBI

Q. What is the currency of India?

A) Dollar

B) Rupee

C) Pound

D) Yen

Correct Answer: B) Rupee

Q. Which of the following is not included in GDP?

A) Final goods

B) Services

C) Intermediate goods

D) Domestic production

Correct Answer: C) Intermediate goods

Q. On what basis is the poverty line determined?

A) Income

B) Consumption

C) Savings

D) Investment

Correct Answer: B) Consumption

Q. Export means—

A) Importing goods from abroad

B) Trade within the country

C) Sending goods abroad

D) Imposing taxes

Correct Answer: C) Sending goods abroad

Q. Import means—

A) Sending goods out of the country

B) Bringing goods from abroad

C) Production within the country

D) Re-export

Correct Answer: B) Bringing goods from abroad

Q. What is the main function of a bank?

A) Tax collection

B) Accepting deposits

C) Making laws

D) Budgeting

Correct answer: B) Accepting deposits

Q. Saving means—

A) Spending the entire income

B) The remaining part of the income

C) Borrowing

D) Investment

Correct answer: B) The remaining part of the income

Q. Economic development means—

A) Only increase in income

B) Only population growth

C) Improvement in income and standard of living

D) Only industrialization

Correct answer: C) Improvement in income and standard of living

Q. An example of direct tax is—

A) GST

B) Customs duty

C) Income tax

D) Excise duty

Correct answer: C) Income tax

Q. An example of indirect tax is—

A) Income tax

B) Property tax

C) GST

D) Agricultural tax

Correct answer: C) GST

Q. What type of economy is the Indian economy?

A) Capitalist

B) Socialist

C) Mixed

D) Communist

Correct answer: C) Mixed

Conclusion

Economics Practice Set 1 is a smart and reliable way to strengthen your concepts and improve exam performance Regular practice with such exam focused questions builds confidence accuracy and speed Stay consistent and success in SSC, UPSC, RRB, Banking and other competitive exams will follow.